How much is antimony worth in 2025?

The Value of Antimony in 2025: Market Trends, Price Analysis, and Future Outlook

Introduction

Antimony (Sb) is a strategic metalloid with critical applications across multiple industries, including flame retardants, lead-acid batteries, semiconductors, and military technologies. As global demand for energy storage and fire-resistant materials grows, the flame retardant Antimony trioxide powder market has seen significant fluctuations in recent years. In 2025, its price remains highly sensitive to supply constraints, geopolitical influences, and technological advancements. This article provides an in-depth analysis of antimony’s current market value, key price drivers, and future projections.

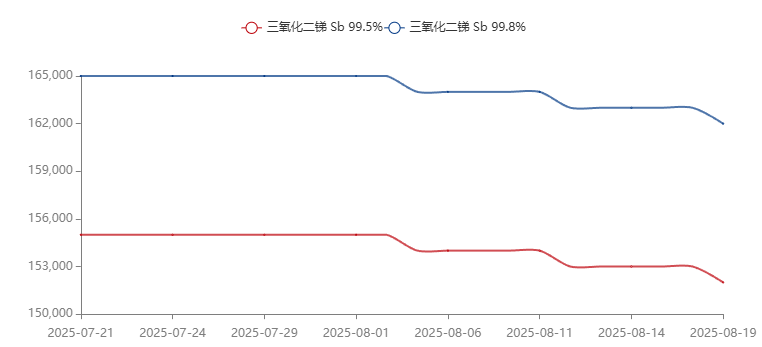

Current Market Price of Antimony in 2025

As of mid-2025, antimony prices vary depending on purity, form (trioxide, ingots, or concentrate), and regional market conditions. The average price ranges between $10,000 and $15,000 per metric ton, with high-purity flame retardant Antimony trioxide powder (used in flame retardants) commanding premiums at the upper end of this range.

Regional Price Variations

China: As the world’s largest producer, Chinese antimony trioxide prices heavily influence global benchmarks. Domestic prices hover around $11,000–$13,000/ton due to controlled exports and environmental regulations.

Europe & North America: Import-dependent markets see slightly higher prices, averaging $12,000–$15,000/ton, factoring in shipping and tariffs.

Key Factors Influencing Antimony Prices in 2025

1. Supply Constraints and Production Dominance

China accounts for ~70% of global antimony trioxide supply, but strict environmental policies and export quotas have tightened availability.

2. Rising Demand from Energy Storage

Lead-Acid Batteries: Antimony trioxide strengthens battery grids, and despite competition from lithium-ion, the lead-acid market remains strong, especially in automotive and backup power systems.

Next-Gen Batteries: Research into antimony-based anodes for lithium-sulfur batteries could significantly boost demand if commercialized.

3. Geopolitical and Trade Dynamics

Export Restrictions: China’s export controls (similar to rare earths) create supply uncertainties.

Sanctions & Trade Wars: U.S.-China tensions and Russia’s role as a secondary supplier add volatility.

Logistical Challenges: Shipping disruptions (e.g., Red Sea conflicts) increase transportation costs.

4. Recycling and Secondary Supply

Only ~30% of Antimony trioxide is recycled, primarily from lead-acid batteries. Improved recycling tech could ease supply pressures but remains underdeveloped.

Future Price Trends and Market Predictions

Analysts project moderate price increases (5–10% annually) due to:

Sustained demand from flame retardants (especially in construction and electronics).

Military and aerospace applications (antimony enhances ammunition and missile components).

For businesses reliant on flame retardant Antimony trioxide powder, securing long-term contracts or exploring recycling partnerships may mitigate price risks. Meanwhile, traders should expect continued volatility with an upward bias.

If you are interested in the antimony trioxide products, please contact us.

Liaoning Victory Fire-Retardant Material Technology Co., Ltd.

Whatsapp:+852 67672160